How to Import Merchandise to the European Union in Times of TLCUEM

We are a few months away from the entry into force of the commercial part of TLCUEM 2.0. In fact, the Ministry of Economy estimates that the exact date will fall within the first semester of 2020. The translation work has begun and it is expected that signatures will be placed in the second part of 2019. Both the Senate of Mexico and the European Parliament will He hopes that they will ratify the agreement within the same year. I thought it would not be a bad idea to see how to import merchandise in these times, with the new version of the Free Trade Agreement between the European Union and Mexico in force.

Although the internal procedures of the European Union are reported in a more advanced state than those of Mexico, the approval of the text by the national parliaments of each member country is still pending. On the part of Mexico, after being approved by the Senate, only its publication in the Official Gazette of the Federation would remain for it to be a fact. So we are still in good time to investigate and learn the tools that assist us in the task of importing merchandise from Mexico to the EU.

The new treaty

Is latest version of TLCUEM to be signed, makes new provisions possible:

• greater market access for the agricultural and fishing sector

• the creation of a trade facilitation chapter

• the guarantee that there are no monopolies for the import and export of raw materials

• the establishment of equal conditions for telecommunications providers

• verifies investment provisions

• designate a digital commerce chapter

• establishes principles for state-owned companies

• founds new anti-corruption articles that guarantee transparency

• provides support to SMEs in foreign trade

In this light, it is certain that the commercial relationship that our country maintains with the European Union will become more crystalline than ever, facilitating import / export in both directions. With the decrease and in most products, the abolition of tariffs, the opportunity arises to bring products to the EU that previously was not possible due to the competition they faced from similar or equal articles, imported from other countries.

Despite the simplifications and advantages that this new version of the Free Trade Agreement between the European Union and Mexico introduces, the majority of Mexicans who live in the old continent are quite confused as to how to carry out the necessary procedures to import products from Mexico to the EU. It is true that the procedure, although less elaborate than ever, is still bureaucratic. Just the mention of the word bureaucracy is enough to disappoint many of us. It does not have to be like that!

With the entry into force of the treaty approaching, a tool has been developed so that importers / exporters can consult it and obtain answers about the costs and other aspects of the management involved. In addition, information about how to perform an import has been made public and it only involves searching, reading and understanding it.

How to import into the European Union

It is exactly this point that this article wants to touch on. We are going to find out the steps that have to be followed to carry out an import to a country of the European Union, focusing on understanding the various aspects of the procedure and the formalities involved to carry it out. In addition, we will examine the "Search Form", a tool of the European Commission that allows us to find the tariff code, the import regulations in the EU, the necessary documents for customs and much more information about the products that we are interested in importing.

Most of the people who are reading this writing are aware of the opportunities that present themselves in the old continent when it comes to Mexican products. The constant struggle to get the necessary food to reproduce our favorite dishes does not let us forget the many deficiencies that we encounter every day. It may be that hats, hammocks, horses, and other souvenirs from Mexico are no longer so difficult to find in many cities in Europe, but how relaxing to find this poblano pepper to make it stuffed or en nogada!

Clarify the objective

Let's see then, what does an import involve. First of all, our importation of merchandise has to be defined. What is the Mexican lacking? Or better yet, what is the Mexican thing that anyone who lives, in the European continent and more specifically, in the European Union, needs? As Prince Hamlet would say, "This is the question!"

I think that most of us who live in this continent have an idea of the answer, although it is different for each one. Assuming you already know what you would like to bring to your adopted country, let's focus on how to export / import a product. Because yes, importing something to a country begins with its export from the country of origin.

Understand your role

Now, you may be thinking that this part is up to the exporting company of the article but there are factors that are your responsibility as an importer and that have to be investigated to decide if the company from which you are going to buy your product, is the one that more convenient for you. That is, almost always a product is offered by many and in various qualities and prices. For example, it is very important to know the production capacity of the exporting company. If your intention is to sell 5000 pcs. per day, it is imperative to ensure that the manufacturer can produce and supply this quantity, even if your needs are much lower at first. There is no point that when the product is at its commercial peak, its sale stops due to lack of copies.

Some other points of consideration are:

• Make sure that the product you want to import has not been imported before and is not represented by any marketer or the manufacturer itself and consequently, it is already available for sale on the continent but not in the country where you live. If it is available on the continent, you will have to take into account the volumes you will need and if you choose to do your own import, the possible exclusivity to the product of the current importer, as well as comparing purchase prices, freight prices and other possible factors that could be related to their availability and movement in the target market

• that the product to be marketed meets the technical specifications and characteristics required in the target market

• properly calculate costs and sales prices

• have international contracts that specify the rights and obligations of each party

• take care that the samples are representative of the product you will sell

• ensure that your product will not be damaged during the trip due to fragility or weather reasons

• take into account the tariff regulations, those of a non-tariff nature and the technical standards that must be met

In addition, many of us would go shopping in Mexico, gathering a quantity of articles to offer in the European market. In this case, you become an exporter / importer and you would have to take care of the obligations of both. Some tips for your character as an exporter are the following:

• if possible, hire a customs broker that would take care of your export (highly recommended)

• choose the most appropriate means of transport (s)

• review the consistency of the documents with respect to the merchandise shipped

• separate packages with markings for immediate identification

• schedule delivery times taking into account eventual delays and, in the case of maritime transport, reserve a place on the ship or container in advance

• evaluate the services of the carriers, verifying their scope and responsibilities

• choose to take out international transport insurance (not mandatory but highly recommended)

Originating products

Another issue that we could face is that of products originating in Mexico whose standards can be found in the Annex III of the Association Agreement (pg. 954). To benefit from preferential rights, such products should be accompanied by a movement certificate EUR.1 which is issued by the Secretariat of Economy of the Mexican Government, upon request by the exporter in writing. With the application, the documentation that proves the character of the and / or the products in question must also be delivered. It is important that the 4-digit classification of exported goods is indicated in section 8 of the certificate, which must be accompanied by the Single Administrative Document (SAD) and validated by the customs office of exit.

The exporter that in this case we suppose that it is you, should type, stamp or print on the invoice, the delivery note or the accompanying commercial document, an "invoice declaration" in the language of the country where it will be exported. But beware! Any exporter can fill out this declaration as long as the value of the products originating in Mexico is € 6000 or less. In case this amount is exceeded, it has to be filled in by an authorized exporter.

Now that we have understood the procedures to carry out an import and if necessary, the export as well, we are going to see the "Search Form", an essential tool that provides us with some important data on our products for import into the European Union. But first, we will see what exactly is the customs territory of the European Union.

Court

The 28 countries of the European Union form a single territory for customs purposes, which means that customs duties are not charged on merchandise that is transferred between member countries, once applied to their entry from countries outside the EU. That is, they are the same for all member countries and are only charged once.

The territory that is included in the Customs Union includes the territories of the following countries:

Belgium, Bulgaria, Czech Republic, Croatia,The Search Form

Let's go back to the "Search Form" and let's see how this tool helps us. Probably, its most important function is to be able to find the tariff codes of the products you will import, fully identifying them. In that way, you can find out the amount you will have to pay for customs duties. In addition, it provides information about documents, procedures and more data, necessary to carry out the import. Let's examine its graphical interface to start learning how to use it.

At first glance, the "Search Form" looks simple: a box with three fields to fill in. The first field asks you for the country from where you want to export the product, which in our case would be “Mexico”. The second field asks us to specify where we want to import the product. Here, the destination of the merchandise is filled in, in our case Germany.

Find the tariff code

The third field asks us for the tariff code of the product. At this point, we will use the assistance provided by the tool to find it. Directly below the field called "Product code", there is a button with the drawing of an eye and the legend "Find the product code" where we click. A pop-up window appears with a list of product categories. Assuming that you want to import fresh poblano peppers, when reviewing the categories that are presented, you will soon discover that the term “chiles” or “peppers” does not appear, which is how chiles are known in Spain.

If you look at the top of the pop-up window, you will notice that there is a search by product name. If you click it, a field appears where you can put the name of the product to find its tariff code. Here, if you put the word "chiles", and you give it in "Quick search", you will have a null result with a warning that "No results have been found for chiles." In this case, you can follow the "Search tips" and change the term to "peppers" but the result is still confusing as there are three pages of categories related to the search.

There is no other option but to use the "Guided Search", which is much more powerful and will give you results, even if you write the term "chilies". First the captcha is filled in and we click on the corresponding search button. Unfortunately, a list appears, only in English, asking you to select the "treatment" or the state in which the product comes. In our case and since we want to import fresh poblano peppers, we select "fresh or chilled only". Now, the result is unique: "Fruits of the genus Capsicum or Pepper".

If we click on the result, a page opens with the category “Other vegetables, fresh or chilled” and we see in dark text, the category “Fruits of the Capsicum or Pepper genres”. The first four digits of the tariff code that appear are normally enough to define the product, however, we will continue to arrive at a complete definition.

By clicking on the (+) symbol, the category expands and two subcategories appear, “Sweet peppers” and “Others”. Now if you do not know what sweet peppers are, you will have to investigate it, which in most of the time does not require more than "googling" the phrase.

When finding out that poblano peppers do not belong to the category of “sweet peppers”, the only other option is “Others” and when clicking on the little cross on the left, the category expands and three more become visible: "Of the genus Capsicum that are intended for the manufacture of capsiscin or Capsicum oleoresin colorants", "That are intended for the industrial manufacture of essential oils or resinoids" and again, "Others". Again, we click the cross on the left side of "Others" and it expands to include two categories, "Peppers (other than sweets) (Capsicum spp)" and yes, you guessed it, "Others." This time, this last category does not have a cross next to it and can be selected.

Product Information

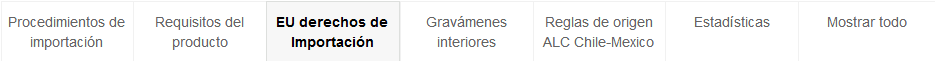

When selecting it, we return to the search interface, only now, the tariff code of poblano peppers appears in the "Product code" field. By clicking on the mustard-colored button and called "See rates and requirements", you have to scroll to the bottom of the page, where a table with several tabs appears, open called "EU import rights ”. In this tab you can find out the tariff that is imposed on your imported product.

From left to right the tabs are: "Import procedures", "Product requirements", "EU import duties" (which we just mentioned), "Internal charges", "Rules of origin ALC Chile - Mexico", " Statistics ”and finally,“ Show all ”.

In the tab "Import procedures" we can see the import procedures and country-specific information pertaining to the tariff code that our search gave us. It is divided into "EU import procedures" where you can see a summary of import procedures, "Documents for customs clearance" where we can find the necessary documentation for customs and "Import procedures and competent authorities for: (the country of import destination, in our case, Germany) ”.

The next tab called “Product Requirements” deals with the specific requirements of the product for its access to the EU market. Here you can see information about the control of variants that can affect the product. In the case of our poblano peppers, information is provided about the control of contaminants, pesticide residues, sanitary, etc. Another thing that you can find out here is the product labeling, that is, the information that must appear on the product label.

We have talked about the next tab so we go to its right, which is called "Internal charges". Here you can see the VAT of the specific country and other taxes that may apply.

The tab “Rules of origin LAC Chile - Mexico is a list of the elaboration or transformation operations that non-originating products must undergo in order to acquire originating status. As they do not apply in all cases, you could also consult the specific elements of rules of origin which are outside the scope of this summary.

In the next tab you can see the statistics of the value and volume of imports and exports of products with the tariff code in question and "Show all" is exactly what it says, all the tabs in one.

Success epilogue

With the TLCUEM, exporting and importing goods has been simplified and made cheaper. However, having a knowledge of the requirements, documents, procedures and the handling of available tools, necessary to carry out the transfer of your products, could make the difference between a successful or unsuccessful result. I invite you to ask your questions and comments in the space directly below this article. What was not clear to you or was not touched on here? I would love to know your questions to be able to develop simple solutions and clear answers to a matter of great interest to our community in Europe.

Of course, if you have a point of sale of Mexican food products on the continent, add him to the Directory so we all know where you are. It's free and we will appreciate it!

The food store image on the cover is courtesy of Danny011974

Excellent information, very educational and totally useful.

Thank you

Thank you very much for your time and comment David. I am very glad that you liked the article. I hope you visit us again soon. Greetings!